The Single Strategy To Use For Mortgage Investment Corporation

Table of ContentsRumored Buzz on Mortgage Investment CorporationThe smart Trick of Mortgage Investment Corporation That Nobody is DiscussingThe 6-Minute Rule for Mortgage Investment CorporationThe smart Trick of Mortgage Investment Corporation That Nobody is DiscussingNot known Facts About Mortgage Investment Corporation

A Home Mortgage Investment Firm (MIC) supplies a passive way to spend in the property market, alleviating the moment and threat of spending in specific home mortgages. It is structured as merged fund and is identified as a different approach. MICs are unique firms produced by an Earnings Tax Obligation Act. The MIC is managed by a manager who is in charge of all elements of the firm's operations, consisting of the sourcing of appropriate home loan investments, the analysis of mortgage applications, and the negotiation of applicable rates of interest, terms and problems, direction of solicitors, mortgage profile and general management.100% of a MIC's yearly internet income, as validated by external audit, be distributed to its investors in the kind of a reward. A MIC's incomes are made up of home mortgage interest and charge income.

A MIC is normally extensively held. No shareholder may hold even more than 25% of the MIC's complete capital. At the very least 50% of a MIC's properties must be comprised of property home mortgages and/or cash and insured deposits at copyright Deposit Insurance policy Corporation member banks. A MIC might invest up to 25% of its assets directly in property yet might not create land or engage in construction.

The globe of investing is complete of choices. There are many distinctions in between these standard investing and alternative investing methods, and with these distinctions come many organizations and companies to pick from.

All About Mortgage Investment Corporation

Let's just claim, the differences are numerous, and it's these distinctions that are vital when it pertains to comprehending the relevance of expanding your investment profile. The major resemblance between a bank and a MIC is the idea of pooling funds with each other to diversify the fund itself, then selling parts of the fund to capitalists.

To expand on the previous factor connected to their terms, with a difference in term lengths comes interest price adjustments. When your financial investments are linked up in an in a bank-related mortgage fund, the size of the term could suggest losing cash in time. Rate of interest can alter on the market, and the passion made on these home mortgages might not as an outcome of fixed-rate fundings.

Our Mortgage Investment Corporation PDFs

A home mortgage pool managed by an MIC will certainly frequently pay returns regular monthly as opposed to quarterly, like bank supplies. This can be of higher advantage to financiers searching for a passive income stream. Typically, when you select to invest in a home loan swimming pool managed by a trusted MIC, you're tapping into their expertise.

At any time you focus your check my reference focus into a specific niche market, you're going to be a lot more familiar and skilled than somebody who has to put on several hats. MICs do not solution to the same regulative companies as banks, and due to this, they have even more liberty. Financial institutions can't take the exact same dangers that private companies or capitalists can profit from.

There are most definitely advantages to investing in even more typical methods.

The 8-Second Trick For Mortgage Investment Corporation

Home is a key resource people require to survive and businesses require to prosper. That makes actual estate a solid organization investment, specifically in this contemporary period. click to read Obviously, individuals will remain to purchase homes to accomplish their personal and company needs. A home loan financial investment corporation can allow you utilize their needs and buy a thriving company that would certainly allow you to earn some severe returns.

Well, right here's every little thing you require to recognize. When a person wishes to buy a building, they generally take a mortgage from a bank or a few other loaning firm. They make use of the obtained cash to acquire the property, then return it in installments to the lender. The returned money includes interest, which is the primary way the lender makes money.

MIC, also lends cash to customers. Unlike typical lenders, MICs additionally allow financiers spend in their service to earn a share of the rate of interest earned. The list below actions are included in the organization process of a MIC.

Mortgage Investment Corporation Things To Know Before You Get This

For the following action, the investor contacts a MIC and asks to invest in their service. If you fulfill the minimum investment requirements for the MIC you're going with, you should be able to get your financial investment via in no time. You can find any type of MIC's minimum financial investment requirements on their internet site.

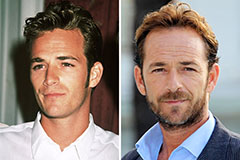

Luke Perry Then & Now!

Luke Perry Then & Now! Andrew Keegan Then & Now!

Andrew Keegan Then & Now! David Faustino Then & Now!

David Faustino Then & Now! Jaclyn Smith Then & Now!

Jaclyn Smith Then & Now! Peter Billingsley Then & Now!

Peter Billingsley Then & Now!